about

COVID-19 HR/Benefits Information

UNY Conference Benefits Office contacts:

Susan Latessa – Director HR/Benefits - susanlatessa@unyumc.org

Julie Valeski – Benefits Administrator - julievaleski@unyumc.org

In 2020, the Conference Board of Pension and Health Benefits (CBOPHB) had approved delayed enforcement of the direct bill arrearage policy through Dec. 31, 2020. Understanding the continued struggle faced by many congregations, the Board has approved to extend that delay through Dec. 31, 2021. If your church is still able to pay their direct bills, they should. If a church is experiencing financial hardship as a result of reduced giving during this time, the church is asked to notify their District Superintendent as well as the Benefits office (Susan Latessa) to discuss their situation. The Upper New York Conference will work with churches on a case-by-case basis.

The following are ways in which the federal government, Guardian Life, and state government can help those affected by the COVID-19-related enforcements pertaining to work.

DCA Election for 2020

Unemployment

IRS Tax Deferment

Employee Assistance Programs (EAP)

Mental Health Benefits

COVID-19 Paid Family Leave and Paid Sick Leave Benefits

What You Need to Know and Do about the CARES Act and Unemployment Insurance

UPDATE: Dependent care Flexible Spending Account (FSA) changes

COVID-19 Update CARES Act—Summary of Potential Impact for the UMC Overview

I9 Form

Message from Wespath to HealthFlex Participants

Relief efforts from Wespath and the CBOPHB during the COVID-19 Crisis

DCA Election for 2020

- Participants are allowed to change or stop their contributions;

- They can use their funds through 12/31/2020 and have up to April 2021 to submit 2020 expenses;

- In addition to traditional brick and mortar programs, the DCA can be used for virtual/online camps such as Virtual Day Care/Camps/Sessions. They include but are limited to: “Live” (i.e. Zoom) sessions that engage the child for a set period such as:

- Interactive Story Time

- Science Experiments and Discussion

- Arts and Crafts Sessions

- Instructional Physical Activity

A computer, laptop or tablet would be needed as the session would be instructor-lead, live.

Places like park districts, libraries, community centers, etc. have begun offering virtual classes/sessions. Participants should check their local areas to see what is offered. If they discover something but they are not sure if it reimbursable through the DCA, they can contact Wespath’s Health Team and they will confirm it with WageWorks. The phone number is 1-800-851-2201.

Unemployment

If you are unable to work due to COVID-19, but do not meet the eligibility requirements of the H.R. 6201 legislation noted above – NOTE: NYS is waiving the 7-day waiting period for Unemployment Insurance benefits for people who are out of work due to Coronavirus (COVID-19) closures or quarantines. Click here to go to the unemployment website where there are instructions on how to file a claim.

IRS Tax Deferment

The IRS filing deadline is now July 15, 2020. You can request an extension for filing beyond the July 15, 2020 deadline. Click here and here for more information.

Employee Assistance Programs (EAP)

There are an abundance of resources available to you every day as a member of the Upper New York Annual Conference through the Employee Assistance Program:

- EAP through Optum Health is for full-time clergy and employee’s enrolled in HealthFlex medical benefits.

- EAP through ESI is for part time clergy and supply pastors appointed to local churches, active clergy over the age of 65, clergy on CPP, part-time year-round Conference employees and Conference employees who waived medical insurance.

Click here to be directed to the EAP programs.

Mental Health Benefits

If you need for inpatient or outpatient mental health benefits, there is coverage under the medical plan through Blue Cross Blue Shield IL. Please click here to read Susan Latessa, UNY Director of Human Resources/Benefits, about the vendor change for mental health/behavioral health claims effective January 1, 2020.

COVID-19 Paid Family Leave and Paid Sick Leave Benefits

U.S. Department of Labor

The United States Department of Labor has issued new guidance regarding the emergency FMLA leave and emergency paid sick leave under the Families First Coronavirus Response Act, including fact sheets and a “questions and answers” page. The USDOL also issued the required poster, together with FAQs about the notice requirement. These are all available on the USDOL’s website at https://www.dol.gov/agencies/whd/pandemic. The guidance clarifies a number of ambiguities from the statute, including the effective date (April 1st), how to count employees, how to pay part-time employees, how to pay full-time employees with varying schedules, how overtime hours factor into the calculation, the interplay between the FMLA and PSL provisions, whether the statute is retroactive and more.

New York State Department of Labor

The New York Department of Labor has also added a new website at https://paidfamilyleave.ny.gov/COVID19. The website also includes a FAQs page at https://paidfamilyleave.ny.gov/new-york-paid-family-leave-covid-19-faqs. On its website, the NYDOL has provided new guidance that clarifies several important points, including how to calculate the paid sick leave compensation, whether the number of paid days is workdays or calendar days, whether school closures can trigger this law, whether the law applies retroactively and more.

What You Need to Know and Do about the CARES Act and Unemployment Insurance

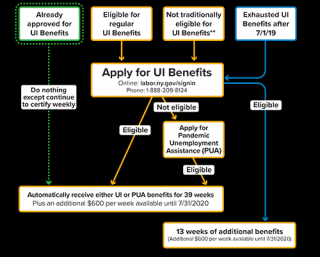

The federal CARES Act was signed into law March 27, 2020. The Act provides enhanced Unemployment Insurance (UI) benefits and Pandemic Unemployment Assistance (PUA) for New Yorkers. Here’s what you need to know.

Click here to view an enlared image of the graphic.

For more information about the CARES Act, Unemployment Insurance, or filing an application, please click here: https://www.labor.ny.gov/ui/cares-act.shtm

FFCRA, EFMLA

Social Security Economic Impact Payments

Andrew Saul, Commissioner of Social Security, reminds the public that Social Security and Supplemental Security Income (SSI) benefit payments will continue to be paid on time during the COVID-19 pandemic. The agency also reminds everyone to be aware of scammers who try to take advantage of the pandemic to trick people into providing personal information or payment via retail gift cards, wire transfers, internet currency, or by mailing cash, to maintain Social Security benefit payments or receive economic impact payments from the Department of the Treasury.

“Social Security will pay monthly benefits on time and these payments will not be affected by the COVID-19 pandemic,” Commissioner Saul said. “I want our beneficiaries to be aware that scammers may try to trick you into thinking the pandemic is stopping or somehow changing your Social Security payments, but that is not true. Don’t be fooled.”

The Department of the Treasury will soon provide information about economic impact payments under the recently enacted law, the Coronavirus Aid, Relief, and Economic Security Act, or CARES Act. Treasury, not Social Security, will be making direct payments to eligible people. Please do not call Social Security about these payments as the agency does not have information to share.

The agency continues to direct the public to its online self-service options whenever possible. Local offices are closed to the public but are available by phone. People can find their local field office phone number by accessing the Field Office Locator.

To allow available agents to provide better phone coverage, the agency is temporarily changing the National 800 number hours starting on Tuesday, March 31, 2020. The hours will change from 7:00 a.m. to 7:00 p.m. local time to 8:00 a.m. to 5:30 p.m. local time. The agency is experiencing longer than normal wait times on the 800 Number and asks the public to remain patient, use its online services at www.socialsecurity.gov, or call their local office.

Please visit the agency’s COVID-19 web page at www.socialsecurity.gov/coronavirus/ for important information and updates.

UPDATE: Dependent care Flexible Spending Account (FSA) changes

If your dependent care needs have changed such that you no longer believe you will spend your full election and/or you need additional funds for dependent care, please contact your plan sponsor and/or the Wespath Health Team to determine whether you may be able to update your election. Changes can only be made prospectively and you cannot reduce your election to less than you have already contributed.

COVID-19 Update CARES Act—Summary of Potential Impact for the UMC Overview

Click here for a term sheet from Wespath to help Conferences and churches with their understanding of the CARES Act Paycheck Protection Program.

Click here for more information about the CARES Act and Paycheck Protection Program regarding UNY churches.

I9 Form

Click here for instructions on how employers should complete an I9 form during the COVID-19 pandemic.

Message from Wespath to HealthFlex Participants

Click here to read the April 8, 2020 issue of On Board Express. There is one article about the CARES Act Update.

Click here to read On Board Express and COVID-19 Updates: Health-Related Expenses for Participants; PPP Loans for Employers

“The information above should not be considered legal or tax advice. Annual conferences, local churches, or other UMC employers should consult with counsel in considering the application of the Act to their circumstances.”

Click here to read an article from Susan Latessa regarding relief efforts from Wespath and the CBOPHB during COVID-19 pandemic.